Q1 REAL ESTATE MARKET UPDATE

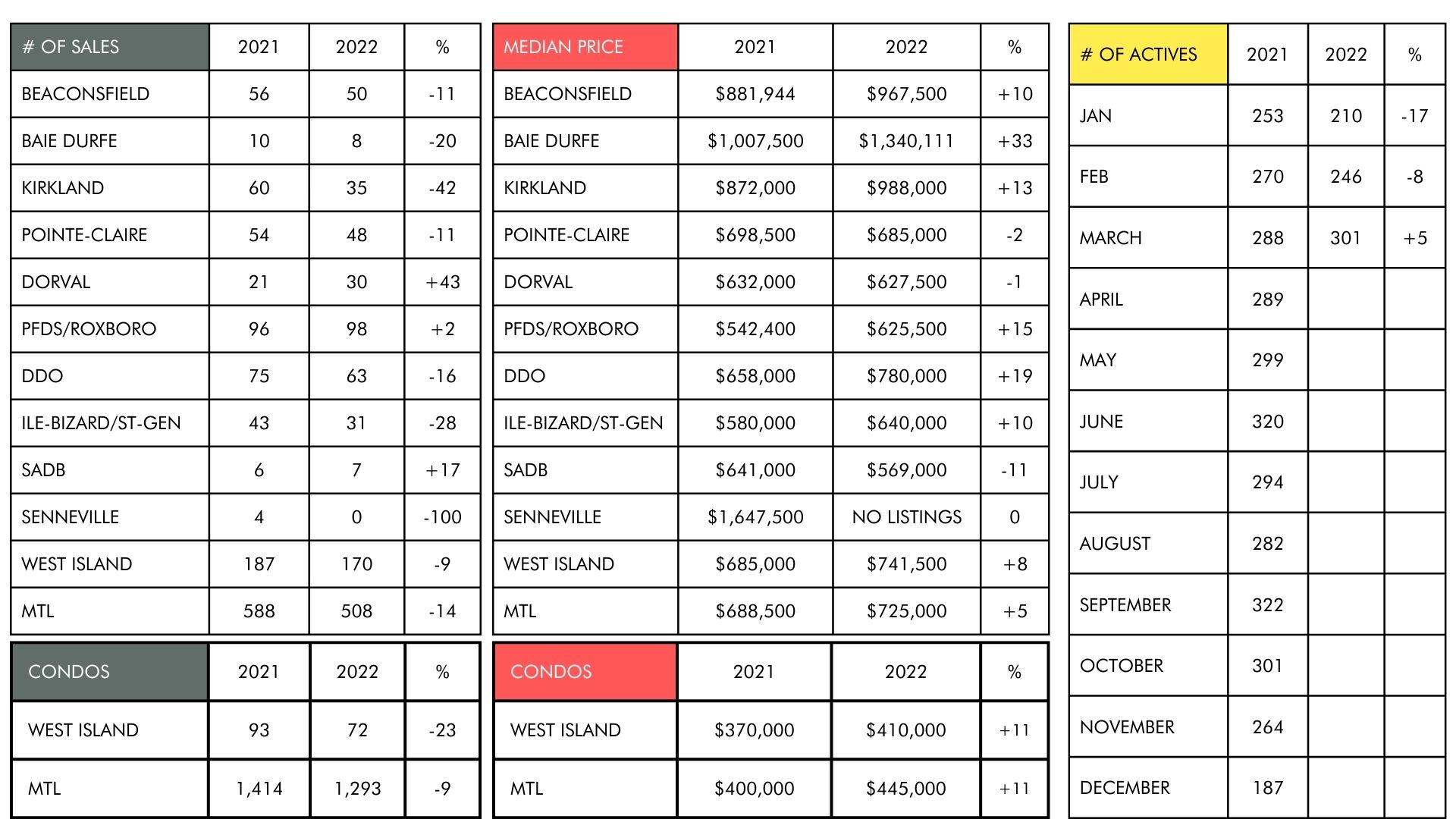

The first Quarter of 2022 continued to show no signs of a slow down as the West Island single family home market saw prices increase by 8% compared to the same period last year while inventory remained critically low at the end of the quarter, with only 301 homes for sale across all value ranges.

This translates into 2 months of inventory, meaning if no other homes came on the market, all the inventory would be sold in 2 months at the current pace of buying. A typical balanced market would have 4-6 months of inventory. To achieve this, inventory would need to rise to between 600-800 homes in the West Island. The last time we had this many homes available for sale was in 2019 when there were 740 homes for sale in March, a very busy month in Canadian real estate. There are currently only around 150 homes available for sale between $500K and $1M.

The number of sales in Q1 2022, was down 9% compared to Q1 2021 as the lack of inventory described above, continued to drive this very strong seller’s market. Had there been more supply, the sales figures would have been higher. There was fierce competition for homes, with many buyers losing out in multiple offers, particularly in the under $1M price ranges.

With 5 full-time brokers on our team representing both buyers and sellers, we have seen our share of some extraordinary bidding wars. We've been on the winning side with some very happy buyers and sellers, but have also experienced a few crushing losses with some buyers who got a taste of the uncertainty of this market.

The entry-level price point in the West Island for a detached starter home is now well over $500K. There were 19 detached homes that sold for under $500K so far this year, but they were all “fixer-uppers”, in less than ideal locations (i.e. in a flood zone near Ile-Bizard or very close to trains, planes or highways).

A typical, move-in-ready, 1,100 to 1,200 sq ft. bungalow in Pointe-Claire, Kirkland, Beaconsfield or Baie D’Urfe is now going for well over $700K. Fully-renovated homes of this size, featuring a garage and in prime locations, can fetch upwards of $950K.

These days $1M will get you a 2-storey cottage that needs updating. With $1,3M to $1,7M you can probably afford a completely redone 4 bedroom, 2.5 bath, 2 storey cottage with a double garage in a great location.

The condo market was also on fire in Q1 2022. Prices jumped 11% compared to Q1 2021, with the number of sales down 23% and inventory sitting at just 1.75 months. This is even less than in the single family segment.

The median price of a condo in the West Island now sits at $410K. This appreciation has pushed many first time buyers into the condo market, further increasing demand.

The high end luxury market is still very active as more affluent buyers are investing in larger, newer homes with modern amenities. Popular features include outdoor living areas, complete with in-ground pools and outdoor cooking and entertaining areas. Home gyms, big garages with electric car charging stations, home offices and large chef kitchens are also in high demand.

It's interesting to note that the trend before the pandemic was more towards smaller homes and less “stuff” as many people were looking to travel more and be at home less. Another example of how the pandemic changed so much about what we value and what makes us feel “at home”.

We are currently seeing a bit of “speculative” pricing among some luxury properties as sellers seem to be testing the waters with some eye popping asking prices that cannot be supported by recent sales data. As of the writing of this article there were 24 homes on the market priced over $3M.

So what do we see happening for the rest of this year? Another interest rate hike or two is definitely in the works as the government looks to cool inflation. So far the quarter point increase we saw in Q1 has had little to no effect.

The Quebec Liberals have announced a platform aimed at abolishing the welcome tax for first time buyers. It seems that all of the parties are focused on affordability when the real issue they should be addressing is supply. We hear from a lot of seniors who say the only reason they are holding onto their large family homes is because they have no viable options to move into.

We will be keeping close tabs on rates and inventory levels and will report back to you at the end of each quarter. As always, if you have any questions about the local market, don’t hesitate to reach out. We would love to hear from you.

Sean, Kim, Scott, Megan and Mark