Has The Real Estate Market Peaked?

The big story this year has been inventory. There are not enough homes to meet demand with only 321 single family homes for sale in the West Island this past June. Canada has the lowest number of homes per capita in the G7, so unless something is done to spurr new construction and increase population density, the inventory problem will likely continue.

Inventory levels are on the rise though. As of July 13th we were up to 341 single family homes on the market. This won’t be enough to cool things down significantly, but with a few more homes to choose from and a feeling among buyers that more inventory is coming, we may have reached the peak. We also saw higher qualifying rates under a stricter mortgage stress test, which drove many entry level buyers off island. This new stress test was implemented June 1st and requires buyers to now qualify at a rate of 5.25%.

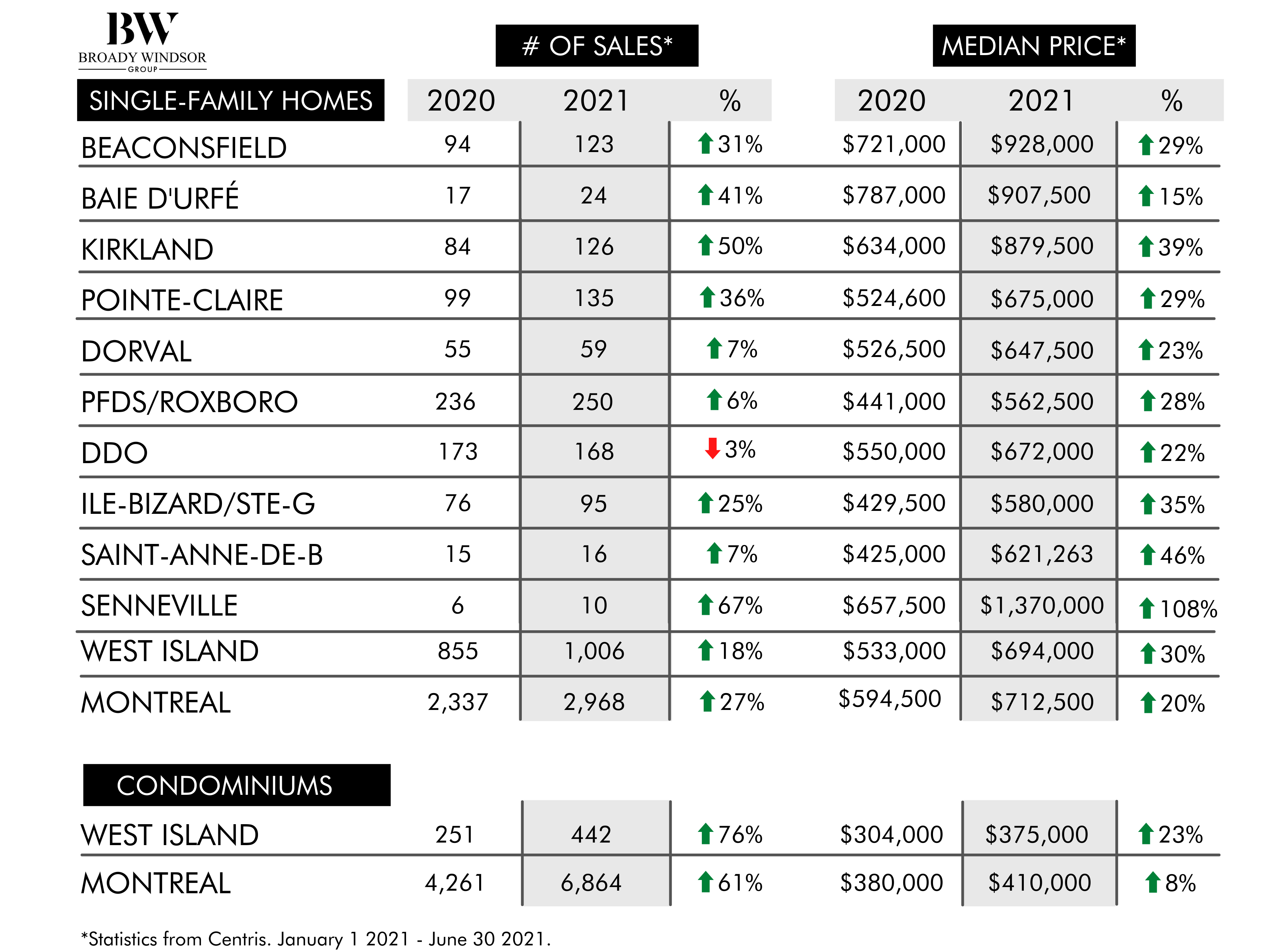

The number of sales were up 21% in the West Island compared to the first half of 2020. The combination of surging demand and limited supply, coupled with historically low interest rates created the perfect storm for bidding wars and a meteoric rise in prices. The median price of a single family home is up 30% in the West Island, compared to the same period last year – $533,000 to $694,000.

Kirkland was the hottest area with the number of sales up 50% (126 this year to date vs 84 from January to June 2020) and the median price jumping 38%. Ile Bizard was a close second with prices increasing by 35% and the number of sales rising by 25%. Not surprisingly, Pointe-Claire and Beaconsfield were also very close with both municipalities seeing the number of sales climb 36% and 31% respectively, while median prices were both up 28%.

On the condo side, it’s the same story. The number of sales sky-rocketed - up 76% this year compared to the same period a year ago. Inventory also remains very low with only 160 condos for sale in June of this year. Compare that to the 478 active listings in June of 2016 and it’s clear what’s been driving the market. We predict the lower end condo market will do extremely well as many entry-level and first-time buyers get priced out of the single-family market.

All signs point towards a surging market through to 2022 in the single family, condo and recreational sectors. Millennials will continue their exodus to the suburbs while baby boomers make lateral moves in terms of price, preferring to live in more rural areas or in homes that don’t require as much maintenance.

If you would like any advice or recommendations all you have to do is call 514-700-2604 or send an email to info@broadywindsor.com. Consider joining the Homeowners Advisory Club. It’s the first real estate concierge service designed to help you protect and maximize the value of your home over time.